Dearest Readers,

You didn't miss a post from me yesterday -- I was getting ready for a big trip! I'm headed to China tomorrow for my MBA program's Global Residency in Shanghai, where I'll be meeting with bigwigs and making a presentation to the heads of a Chinese financial services company. Wish me luck!

Posts will resume on March 20, after I've returned.

Wishing you rich returns,

Vonetta

Thursday, February 28, 2013

Wednesday, February 20, 2013

A diverse world is a safe(r) world

And by "world" I, of course, mean your stock portfolio.

So far, in each blogpost, I've explained the basics of what you need to know to buy the stock of an individual company. Although you do need to know this, a more important [and very familiar] principle stands:

Avoid putting all your eggs in one basket.

This principle is known as diversification. Basically, it involves owning a number of stocks of companies in different industries, geographies, etc etc. You might hear the rule that a properly diversified investment portfolio contains 30 to 40 stocks, which you can gather yourself OR you can let someone else do it for you, with a mutual fund or an exchange-traded fund.

A mutual fund is a diverse portfolio of stocks (or bonds) that is managed by an asset management firm. The "mutual" part comes from the fact that it is funded by a ton of different people. Money is pooled from many different investors and the asset manager invests on their behalf.

If your job offers you a 401k or 403b plan, you have likely bought a mutual fund. It is one of the easiest, best ways to get a diversified portfolio, since these funds can include hundreds, or even thousands, of stocks.

Another way to get diversity is through an exchange-traded fund, more widely known as an ETF. ETFs work essentially the same way as a mutual fund, but is traded on an exchange, such as the New York Stock Exchange. Mutual funds are not publicly traded, so an ETF can be more convenient for those who do not have access to a 401k plan.

Both mutual funds and ETFs give you about a million investing options. Some funds invest companies in one industry specifically; some invest based on geographies. Some reflect popular indices such as the Dow Jones Industrial Average or the S&P 500, called index funds.

Conservative Wall Street veterans will likely recommend that you go with an index fund, particularly one that includes more companies rather than fewer. While the Dow's price is frequently quoted, the index is made up of only 30 stocks, the largest companies in the US. Bigger isn't always better: these companies don't necessarily reflect what's going on in the whole market. The S&P 500, which contains 500 companies' stocks, is a better bet, and the Wilshire 5000, even better.

So next time you're tinkering with your job's 401k, don't be shy. See what index funds are available. Next time, I'll teach out how to seek out the best for you.

So far, in each blogpost, I've explained the basics of what you need to know to buy the stock of an individual company. Although you do need to know this, a more important [and very familiar] principle stands:

Avoid putting all your eggs in one basket.

This principle is known as diversification. Basically, it involves owning a number of stocks of companies in different industries, geographies, etc etc. You might hear the rule that a properly diversified investment portfolio contains 30 to 40 stocks, which you can gather yourself OR you can let someone else do it for you, with a mutual fund or an exchange-traded fund.

A mutual fund is a diverse portfolio of stocks (or bonds) that is managed by an asset management firm. The "mutual" part comes from the fact that it is funded by a ton of different people. Money is pooled from many different investors and the asset manager invests on their behalf.

If your job offers you a 401k or 403b plan, you have likely bought a mutual fund. It is one of the easiest, best ways to get a diversified portfolio, since these funds can include hundreds, or even thousands, of stocks.

Another way to get diversity is through an exchange-traded fund, more widely known as an ETF. ETFs work essentially the same way as a mutual fund, but is traded on an exchange, such as the New York Stock Exchange. Mutual funds are not publicly traded, so an ETF can be more convenient for those who do not have access to a 401k plan.

Both mutual funds and ETFs give you about a million investing options. Some funds invest companies in one industry specifically; some invest based on geographies. Some reflect popular indices such as the Dow Jones Industrial Average or the S&P 500, called index funds.

Conservative Wall Street veterans will likely recommend that you go with an index fund, particularly one that includes more companies rather than fewer. While the Dow's price is frequently quoted, the index is made up of only 30 stocks, the largest companies in the US. Bigger isn't always better: these companies don't necessarily reflect what's going on in the whole market. The S&P 500, which contains 500 companies' stocks, is a better bet, and the Wilshire 5000, even better.

So next time you're tinkering with your job's 401k, don't be shy. See what index funds are available. Next time, I'll teach out how to seek out the best for you.

Wednesday, February 13, 2013

My Conversation with the CEO of Michael Kors / Breaking Up is Hard to Do

Those who follow me on Twitter know how excited I was about John Idol, CEO of Michael Kors, speaking at my university last week. It was a great talk and I fell more in love with the brand by the end of it. But I still couldn't shake the question that's been gnawing at me for the past several months.

So I asked John during the Q&A (after thanking him, on behalf of my stock portfolio, for going public): "How do you respond to equity analysts who say you're growing too fast? Your PE is at 45, and Coach's is 12. What do you say when they ask if this growth rate is sustainable?"

"Great question," he said. Then he squinted and asked, "Is that a Michael Kors watch?"

Yes, it was. :)

His answer to my question was that Michael Kors is filling the "white space" of accessible luxury wherever it can. They will cap the number of stores at certain number, but the company does not want to keep itself from going to places where it could succeed. They don't think about price-earnings ratios, he said; they think about where they can fill a void.

I was somewhat satisfied with his response. In particular, I was comforted that they will set some limits on the growth, but not impede it. However, given yesterday's earnings report of 70% revenue growth, I still wonder if MK is just a really hot trend that can fall out of fashion at any moment.

---

This leads me to an important, but painful topic: when do you sell a stock?

I have many stories about selling stocks at the wrong time. Hopefully, I've learned my lesson and can share with you my mistakes, so you don't make them.

There are 3 main reasons to sell a stock: a change in price, a change in the company, or a change in your situation.

A change in price:

When a stock has hit your target price, it may be time to say good-bye. The target price is the share price at which you say, "There is no way this stock is going to go higher." While you can rarely ever be certain of this, it is always a good idea to have a certain target in mind. This tempers your expectations: you'll patiently wait for the price to go up and/or you'll sell at a high price instead of a low one.

You may have heard the phrase, "Buy low, sell high." It's an investing commandment that every investor sins against. TRY TO FOLLOW IT. Don't get emotionally attached to a stock and believe that if it falls and keeps falling, it will go back up. It might, but there's no way of guaranteeing, so get out while you can while it's hot.

The downside to selling high is that you may miss any additional upside, or share price increases. Well, better safe than sorry, I say. It's better to collect something than to collect losses.

A change in the company:

You'll likely want to sell a stock when the company's finances have deteriorated. If revenues and profits are falling, and expenses and debt are increasing, it does not paint a nice picture for investors.

Take Avon, for example. Although it is a classic, iconic brand, the company has not been able to perpetuate its business model (door-to-door salesladies) in the age of the Internet. This has taken a toll on Avon's revenues and profits. It has mounted up quite a bit of debt as it tries to survive. The company's stock price has reflected its troubles in recent years: even well before the 2008/09 market crash, Avon's stock traded on average between $35 and $40 per share. Now it bearly reaches $20.

In addition to slacking financial fundamentals, other reasons to consider selling a stock could be:

A change in your situation:

Your decision to sell a stock could come from your own situation. For example, let's say you think another company's stock is worth buying, but you can't afford to own them both. If you believe the new stock will perform better, it might be worth tossing the old one.

Also, stocks are extremely liquid, which means that they can be sold easily. So, if you need cash in pinch, you can always sell your stock without penalties. However...

The tax implications may not be worth it.

When you sell a stock at a higher price than what you paid for it, you have to pay what's called a capital gains tax, which is generally 15% of the gain. This automatically decreases the return you actually recieve. And don't forget that you have to pay commission on the sale to your broker!

Basically, selling a stock can be very expensive, so make sure you are SURE that you want to do it before you go through with it.

I bought 10 shares of Michael Kors for about $33/share on February 2, 2012, just a couple of months after it had gone public. On Valentine's Day, the price jumped to $42/share, after a great earnings report. The price lingered between $39 and $42 for a couple of weeks, and in early March, I sold all 10 shares for $43. I'd made about $100, so I was happy.

Sadly, the price kept going up, and I got antsy. So I dove back in. For $48. I could only afford 5 shares this time. So not only did I buy the shares at a much higher price, I couldn't even own anywhere near as many. :(

The upside to this story is that I still own the 5 shares, and as of yesterday, they bounced to $63/share. While I do believe Michael Kors is growing too quickly now (the PE jumped to 50 after yesterday's 70% revenue growth announcement), I believe in the long-term potential of the brand, so I plan to hold on for years to come, unless something tells me otherwise.

Ultimately, you should strive to be an "investor," or someone who holds stocks for a least a year, not a "trader," someone who holds them for less than a year. It is important to remember that value comes with time, so be patient and leave your emotions at the door.

--

Next week, we'll talk diversity. A diverse world is a safe world. At least for your stock portfolio.

So I asked John during the Q&A (after thanking him, on behalf of my stock portfolio, for going public): "How do you respond to equity analysts who say you're growing too fast? Your PE is at 45, and Coach's is 12. What do you say when they ask if this growth rate is sustainable?"

"Great question," he said. Then he squinted and asked, "Is that a Michael Kors watch?"

Yes, it was. :)

His answer to my question was that Michael Kors is filling the "white space" of accessible luxury wherever it can. They will cap the number of stores at certain number, but the company does not want to keep itself from going to places where it could succeed. They don't think about price-earnings ratios, he said; they think about where they can fill a void.

I was somewhat satisfied with his response. In particular, I was comforted that they will set some limits on the growth, but not impede it. However, given yesterday's earnings report of 70% revenue growth, I still wonder if MK is just a really hot trend that can fall out of fashion at any moment.

---

This leads me to an important, but painful topic: when do you sell a stock?

I have many stories about selling stocks at the wrong time. Hopefully, I've learned my lesson and can share with you my mistakes, so you don't make them.

There are 3 main reasons to sell a stock: a change in price, a change in the company, or a change in your situation.

A change in price:

When a stock has hit your target price, it may be time to say good-bye. The target price is the share price at which you say, "There is no way this stock is going to go higher." While you can rarely ever be certain of this, it is always a good idea to have a certain target in mind. This tempers your expectations: you'll patiently wait for the price to go up and/or you'll sell at a high price instead of a low one.

You may have heard the phrase, "Buy low, sell high." It's an investing commandment that every investor sins against. TRY TO FOLLOW IT. Don't get emotionally attached to a stock and believe that if it falls and keeps falling, it will go back up. It might, but there's no way of guaranteeing, so get out while you can while it's hot.

The downside to selling high is that you may miss any additional upside, or share price increases. Well, better safe than sorry, I say. It's better to collect something than to collect losses.

A change in the company:

You'll likely want to sell a stock when the company's finances have deteriorated. If revenues and profits are falling, and expenses and debt are increasing, it does not paint a nice picture for investors.

Take Avon, for example. Although it is a classic, iconic brand, the company has not been able to perpetuate its business model (door-to-door salesladies) in the age of the Internet. This has taken a toll on Avon's revenues and profits. It has mounted up quite a bit of debt as it tries to survive. The company's stock price has reflected its troubles in recent years: even well before the 2008/09 market crash, Avon's stock traded on average between $35 and $40 per share. Now it bearly reaches $20.

In addition to slacking financial fundamentals, other reasons to consider selling a stock could be:

- The company is going in a different direction, perhaps one that doesn't make sense given what the company is good at.

- It could have gotten new leadership that doesn't inspire quite like the old leadership (I'm afraid Apple might become the next example of this).

- It has cut its dividend, which is a sign it could be going through financial trouble.

A change in your situation:

Your decision to sell a stock could come from your own situation. For example, let's say you think another company's stock is worth buying, but you can't afford to own them both. If you believe the new stock will perform better, it might be worth tossing the old one.

Also, stocks are extremely liquid, which means that they can be sold easily. So, if you need cash in pinch, you can always sell your stock without penalties. However...

The tax implications may not be worth it.

When you sell a stock at a higher price than what you paid for it, you have to pay what's called a capital gains tax, which is generally 15% of the gain. This automatically decreases the return you actually recieve. And don't forget that you have to pay commission on the sale to your broker!

Basically, selling a stock can be very expensive, so make sure you are SURE that you want to do it before you go through with it.

I bought 10 shares of Michael Kors for about $33/share on February 2, 2012, just a couple of months after it had gone public. On Valentine's Day, the price jumped to $42/share, after a great earnings report. The price lingered between $39 and $42 for a couple of weeks, and in early March, I sold all 10 shares for $43. I'd made about $100, so I was happy.

Sadly, the price kept going up, and I got antsy. So I dove back in. For $48. I could only afford 5 shares this time. So not only did I buy the shares at a much higher price, I couldn't even own anywhere near as many. :(

The upside to this story is that I still own the 5 shares, and as of yesterday, they bounced to $63/share. While I do believe Michael Kors is growing too quickly now (the PE jumped to 50 after yesterday's 70% revenue growth announcement), I believe in the long-term potential of the brand, so I plan to hold on for years to come, unless something tells me otherwise.

Ultimately, you should strive to be an "investor," or someone who holds stocks for a least a year, not a "trader," someone who holds them for less than a year. It is important to remember that value comes with time, so be patient and leave your emotions at the door.

--

Next week, we'll talk diversity. A diverse world is a safe world. At least for your stock portfolio.

Wednesday, February 6, 2013

Put it all together and what does it spell? $$$

So, now that you know all about how to read financial statements (see here and here, if you missed them), let's see how they all fit together.

Let's use Coach, Inc. (COH) for our example. Although the company recently saw a decline in profits, it's still financially solid. Let's have a look:

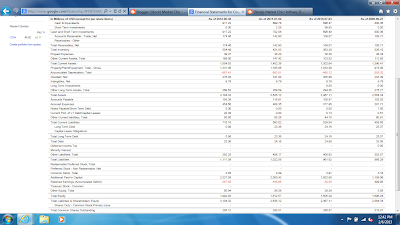

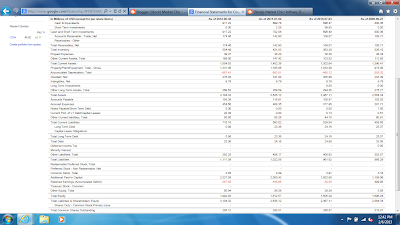

Balance Sheet:

For simplicity's sake, we'll look at annual data. Financial information comes out quarterly (and the date of "quarter end" depends on the company), but it's better to get the big picture view and not freak out if there is a small earnings drop in one quarter.

You'll see that total assets, especially cash, has steadily increased (Great sign!), and although total liabilities have also increased, they are proportional to assets. Coach hasn't taken out an exorbitant amount of debt that it will never be able to pay back. Actually, Coach's long term debt has DECREASED, which is great.

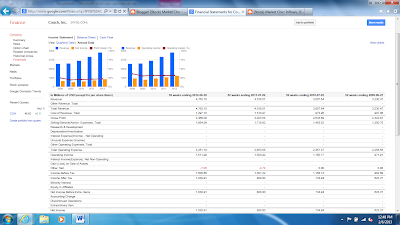

Income Statement:

I've cut the screen shot off here at net income. There's a whole mess of lines that come after that, but we're going to focus on revenues, expenses, and the Bottom Line.

Notice that Coach's annual revenues have, again, steadily increased. That's why it's important to look at the big picture -- there may be dips some quarters, but annual revenues should grow consistently, as should gross profit. Expect expenses to increase; it's totally okay AS LONG AS THEY ARE PROPORTIONAL TO REVENUES. Fractions should stay intact!

Coach is a great example of a company that has been around forever, but still manages to grow wildly, evidenced in the large leaps in net income. While competitors such as Michael Kors and Tori Burch are starting to eat into the market, Coach is still a strong player, taking advantage of growth opportunities around in the world, not just in the US.

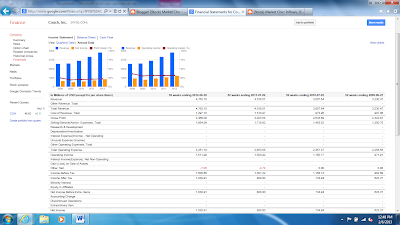

Cash Flow Statement:

Cash flow statements are generally the shortest of the financial statements, so, no, your eyes are not playing tricks on you.

You'll see that, in recent years, Coach has pulled in more cash than it has paid out (negative numbers are payouts, positive numbers are inflows), which has pluses and minuses for investors. Plus: The company has cash to pay its bills, so it's not going under any time soon. Minus: The company has cash that it has not given to you, and it is just sitting there.

Notice that the amount paid out as dividends is getting increasingly negative -- that's a good thing: the dividend to investors has increased. Buuuuut, by the end of fiscal year 2012, Coach pulled in an extra $217 million in cash. An investor has to ask herself what the company plans to do with all that, if the dividend is not going to increase. Luckily, Coach has some changes in its retail offerings in store, so we'll soon witness them put that cash to work.

And that's that! Not so bad, huh? Surprisingly simple? Of course this can get infinitely more complicated, and it does, but I won't take you through all that. (If you'd like to know all there is to know, I recommend your local top-25 ranked MBA program.)

Now, you're armed. You know the basics of individual stock selection, you can spot a good stock investment when you see one, when to buy it, when to...sell it?

We'll touch on the delicate topic of ending a stock relationship when we return after these brief messages from our sponsor!

Let's use Coach, Inc. (COH) for our example. Although the company recently saw a decline in profits, it's still financially solid. Let's have a look:

Balance Sheet:

For simplicity's sake, we'll look at annual data. Financial information comes out quarterly (and the date of "quarter end" depends on the company), but it's better to get the big picture view and not freak out if there is a small earnings drop in one quarter.

You'll see that total assets, especially cash, has steadily increased (Great sign!), and although total liabilities have also increased, they are proportional to assets. Coach hasn't taken out an exorbitant amount of debt that it will never be able to pay back. Actually, Coach's long term debt has DECREASED, which is great.

Income Statement:

I've cut the screen shot off here at net income. There's a whole mess of lines that come after that, but we're going to focus on revenues, expenses, and the Bottom Line.

Notice that Coach's annual revenues have, again, steadily increased. That's why it's important to look at the big picture -- there may be dips some quarters, but annual revenues should grow consistently, as should gross profit. Expect expenses to increase; it's totally okay AS LONG AS THEY ARE PROPORTIONAL TO REVENUES. Fractions should stay intact!

Coach is a great example of a company that has been around forever, but still manages to grow wildly, evidenced in the large leaps in net income. While competitors such as Michael Kors and Tori Burch are starting to eat into the market, Coach is still a strong player, taking advantage of growth opportunities around in the world, not just in the US.

Cash Flow Statement:

Cash flow statements are generally the shortest of the financial statements, so, no, your eyes are not playing tricks on you.

You'll see that, in recent years, Coach has pulled in more cash than it has paid out (negative numbers are payouts, positive numbers are inflows), which has pluses and minuses for investors. Plus: The company has cash to pay its bills, so it's not going under any time soon. Minus: The company has cash that it has not given to you, and it is just sitting there.

Notice that the amount paid out as dividends is getting increasingly negative -- that's a good thing: the dividend to investors has increased. Buuuuut, by the end of fiscal year 2012, Coach pulled in an extra $217 million in cash. An investor has to ask herself what the company plans to do with all that, if the dividend is not going to increase. Luckily, Coach has some changes in its retail offerings in store, so we'll soon witness them put that cash to work.

And that's that! Not so bad, huh? Surprisingly simple? Of course this can get infinitely more complicated, and it does, but I won't take you through all that. (If you'd like to know all there is to know, I recommend your local top-25 ranked MBA program.)

Now, you're armed. You know the basics of individual stock selection, you can spot a good stock investment when you see one, when to buy it, when to...sell it?

We'll touch on the delicate topic of ending a stock relationship when we return after these brief messages from our sponsor!

Subscribe to:

Posts (Atom)