Let's use Coach, Inc. (COH) for our example. Although the company recently saw a decline in profits, it's still financially solid. Let's have a look:

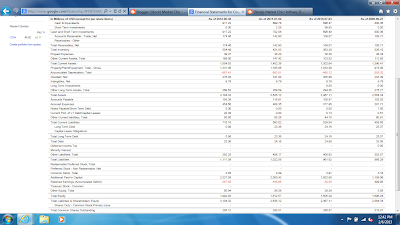

Balance Sheet:

For simplicity's sake, we'll look at annual data. Financial information comes out quarterly (and the date of "quarter end" depends on the company), but it's better to get the big picture view and not freak out if there is a small earnings drop in one quarter.

You'll see that total assets, especially cash, has steadily increased (Great sign!), and although total liabilities have also increased, they are proportional to assets. Coach hasn't taken out an exorbitant amount of debt that it will never be able to pay back. Actually, Coach's long term debt has DECREASED, which is great.

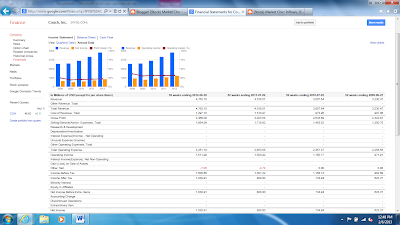

Income Statement:

I've cut the screen shot off here at net income. There's a whole mess of lines that come after that, but we're going to focus on revenues, expenses, and the Bottom Line.

Notice that Coach's annual revenues have, again, steadily increased. That's why it's important to look at the big picture -- there may be dips some quarters, but annual revenues should grow consistently, as should gross profit. Expect expenses to increase; it's totally okay AS LONG AS THEY ARE PROPORTIONAL TO REVENUES. Fractions should stay intact!

Coach is a great example of a company that has been around forever, but still manages to grow wildly, evidenced in the large leaps in net income. While competitors such as Michael Kors and Tori Burch are starting to eat into the market, Coach is still a strong player, taking advantage of growth opportunities around in the world, not just in the US.

Cash Flow Statement:

Cash flow statements are generally the shortest of the financial statements, so, no, your eyes are not playing tricks on you.

You'll see that, in recent years, Coach has pulled in more cash than it has paid out (negative numbers are payouts, positive numbers are inflows), which has pluses and minuses for investors. Plus: The company has cash to pay its bills, so it's not going under any time soon. Minus: The company has cash that it has not given to you, and it is just sitting there.

Notice that the amount paid out as dividends is getting increasingly negative -- that's a good thing: the dividend to investors has increased. Buuuuut, by the end of fiscal year 2012, Coach pulled in an extra $217 million in cash. An investor has to ask herself what the company plans to do with all that, if the dividend is not going to increase. Luckily, Coach has some changes in its retail offerings in store, so we'll soon witness them put that cash to work.

And that's that! Not so bad, huh? Surprisingly simple? Of course this can get infinitely more complicated, and it does, but I won't take you through all that. (If you'd like to know all there is to know, I recommend your local top-25 ranked MBA program.)

Now, you're armed. You know the basics of individual stock selection, you can spot a good stock investment when you see one, when to buy it, when to...sell it?

We'll touch on the delicate topic of ending a stock relationship when we return after these brief messages from our sponsor!

No comments:

Post a Comment